Chip Easy Access Account

Our easy access savings account, designed for long-term savings.

Interest accrues daily, paid monthly

Easy access with instant deposits and withdrawals

Three penalty-free withdrawals in a 12 month period.

Please note: This promotion cannot be used in conjunction with any other Boosted Rate Promotion. Only one promotional rate can be applied to your Chip Easy Access account at any one time.

To be eligible for the Boosted Easy Access Promotional Rate you must be a new Chip customer. A new customer is defined as someone who has never previously transacted in a Chip account and has no other promotional rates applied on any Chip products.

How to open your

Chip Easy Access Account

We've made it easy to start building wealth with our savings accounts. No forms or fuss, get started in just a few minutes.

Download

Get started by downloading the Chip app from the App Store or Google Play.

Sign up

Follow our in-app prompts to set up your account.

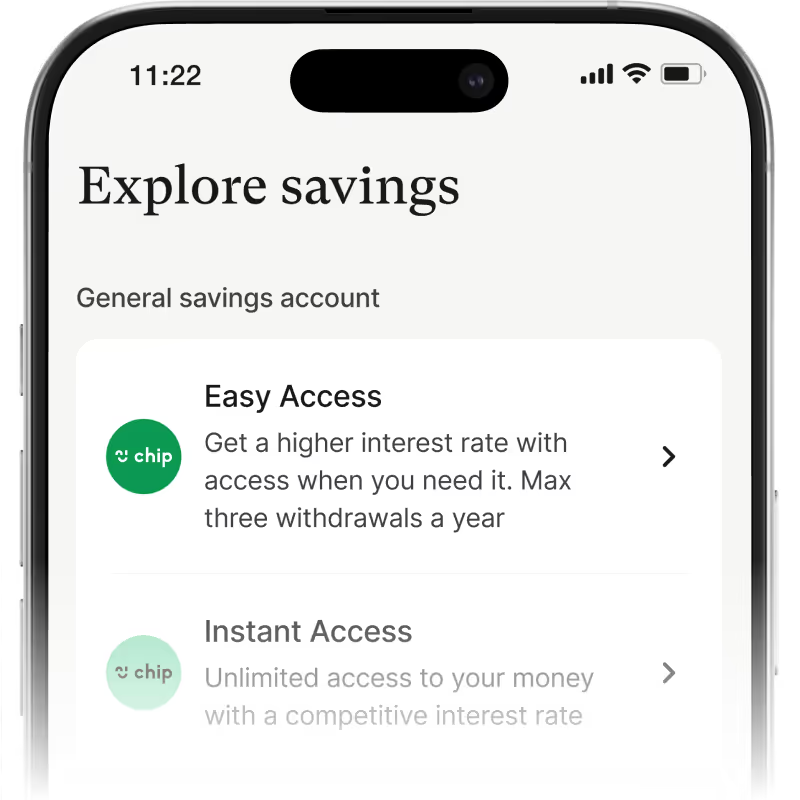

Open a Chip Easy Access Account

On the ‘Savings’ tab of your Chip app, select the Chip Easy Access.

Connect your bank

In order to make near instant saves and withdrawals, you just need to connect your bank. Follow the simple steps to add your account in a few taps.

You’ve claimed your boost!

The boost will be applied to your account automatically. Make your first deposit via bank transfer and that’s it.

Easy access

This is an easy access savings account (as opposed to a notice or a fixed-term account).

We understand that ready access to savings is important for our members, which is why this account enables instant withdrawals and deposits via bank transfer. There’s no limit to the amount you can move in one go.

How to open your Easy Access Saver account.

We've made it easy to start building wealth with our savings accounts. No forms or fuss, get started in just a few minutes - download the app via Google Play or App Store.

Find 'Savings' tab

On the ‘Savings’ tab of your Chip app, you can choose from a range of savings accounts offering great interests rates and chances to win big prizes.

Connect your bank

In order to make near instant saves and withdrawals, you just need to connect your bank. Follow the simple steps to add your account in a few taps.

Start saving!

Make your first deposit via bank transfer, from your Chip savings accounts or debit card and that’s it. Your account is open!

.avif)

Covered by FSCS

All money deposited into a savings or investment account through Chip is eligible for cover by the Financial Services Compensation Scheme (FSCS), subject to FSCS conditions.

The first £120,000 you deposit into your savings account is covered by FSCS, meaning that in the unlikely event that one of our banking partners fails, you will be protected and your money will be safe. Find out more about how we keep your money safe.

.png)

FAQs

Everything you’ve ever wanted to know about the Chip Easy Access Account and open banking. Find all our up to date terms here.

Your rate boost is applied automatically as soon as your Easy Access Saver account is open.

Transfers between different accounts, whether within Chip or to an external account, are considered withdrawals.

To maintain the standard/basic interest rate, it’s important to limit your withdrawals to a maximum of three per 12-month period

No, there is no minimum balance required to open or maintain a Chip Easy Access Saver account.

You can start with any amount that suits your savings goals and build your balance over time.

Interest on the Chip Easy Access Saver accrued daily and paid out monthly (on the fourth working day of the month). This means you can see your savings grow consistently over time, with interest added to your account each month.