Chip Instant Access Account

Unlimited access to your money whenever you need it and a competitive interest rate.

Deposit and withdraw almost instantly.

FSCS protection up to £120,000.

Please note: This promotion cannot be used in conjunction with any other Boosted Rate Promotion. Only one promotional rate can be applied to your Chip Instant Access account at any one time.

How to open your Instant Access Account

We've made it easy to start building wealth with our savings accounts. No forms or fuss, get started in just a few minutes.

Download

Get started by downloading the Chip app from the App Store or Google Play.

Sign up

Follow our in-app prompts to set up your account.

Open a Chip Instant Access Account

On the ‘Savings’ tab of your Chip app, select the Chip Instant Access.

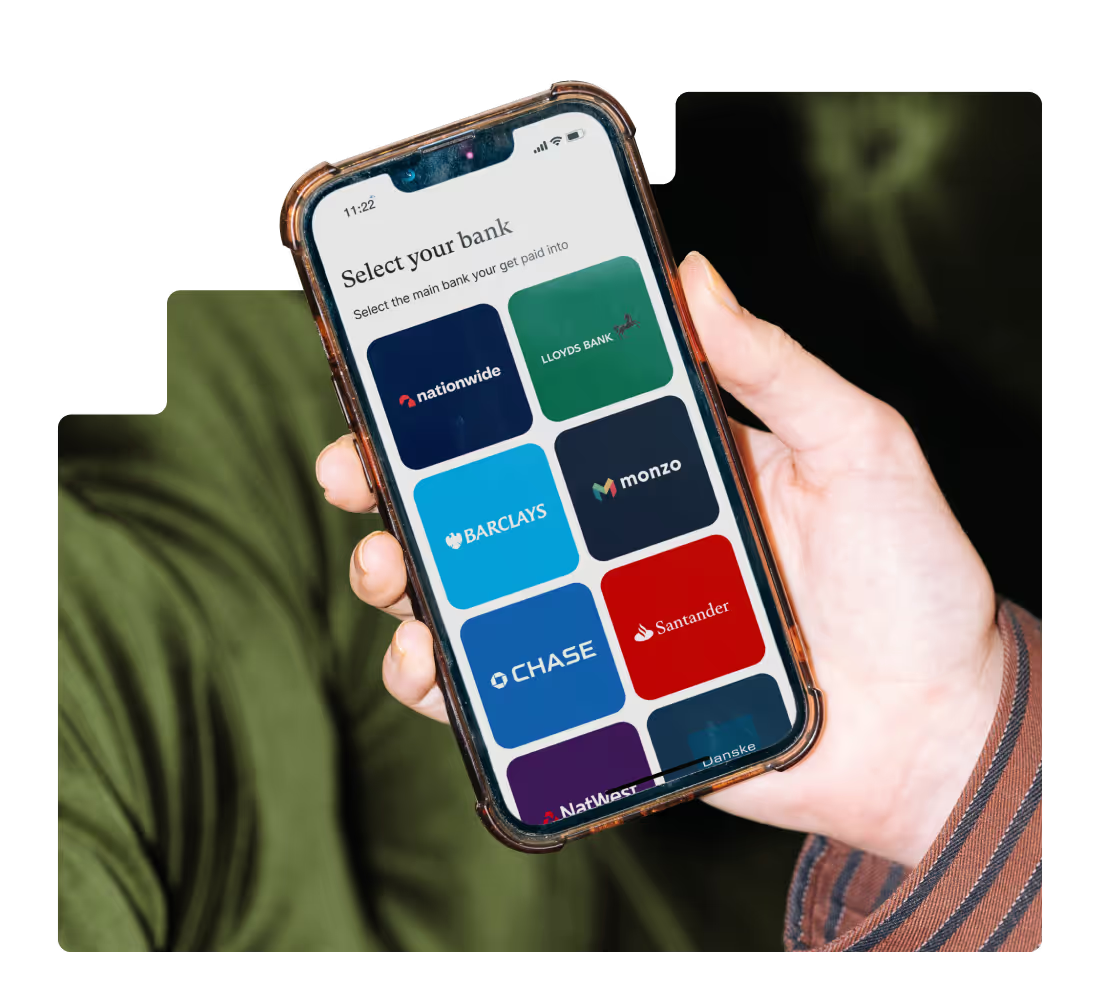

Connect your bank

In order to make near instant saves and withdrawals, you just need to connect your bank. Follow the simple steps to add your account in a few taps.

You’ve claimed your boost!

The boost will be applied to your account automatically. Make your first deposit via bank transfer and that’s it.

Compare our rates

We’re currently offering an Instant Access rate boost promotion for

new customers only

This is just an example that assumes that you do not add or take out any money and that there was no change to the interest rate during the period.

This is just an example that assumes that you do not add or take out any money and that there was no change to the interest rate during the period.

Hands-free saving

Autosaving is one of the many ways Chip empowers you to save effortlessly. By using our award-winning automatic saving feature, the app will intelligently save money for you based on your chosen autosave level.

Leveraging open banking, Chip seamlessly integrates with your linked bank account, meaning we can create personalised autosaves that align with your unique needs and spending behaviours. It's a tailored saving solution that adapts to your financial habits.

.avif)

Covered by FSCS

All money deposited into a savings or investment account through Chip is eligible for cover by the Financial Services Compensation Scheme (FSCS), subject to FSCS conditions.

The first £120,000 you deposit into your savings account is covered by FSCS, meaning that in the unlikely event that ClearBank or Chip fails, you will be protected and your money will be safe. Find out more about how we keep your money safe.

.png)

The benefits of open banking.

Open banking is an integral part of Chip’s wealth building technology. With access to customer-permitted financial data, we can help you save more, and save smarter. Open banking operates on a consent-based model, meaning everyone has control over their financial data.

Save more and save smarter.

Choose to share information with third-party providers.

Revoke access at any time.

FAQs

The Bank of England Bank Rate, often simply referred to as the base rate, is the interest rate at which the Bank of England lends money to commercial banks. It serves as a benchmark for all other interest rates in the economy, influencing the rates that banks offer on their lending and savings products.

The Monetary Policy Committee (MPC), a group within the Bank of England, sets the base rate based on economic conditions, with the primary aim of managing inflation. MPC decisions are widely reported on and their meeting notes are a matter of public record.

Yes. There are no fees or charges for holding this account. Please see our pricing page for general fee information. Please note that our Saving Plans features do carry fees.

Yes, the Chip Instant Access Account rate is variable. That means we can change it up or down at our discretion.

You’ll have likely seen that we aim to follow movements from the Bank of England base rate of interest, but we’ll also take the easy-access savings market into consideration too, in order to ensure Chip customers always get a competitive rate of interest.

Should Chip set a date to lower the interest rate, you will be given a minimum of 14 days’ notice. You may receive less notice if the rate increases.

The eligible balance of your account has Financial Services Compensation Scheme (FSCS) protection up to £120,000, which also includes the interest accredited to the account each month. You can read more about how we protect your money here.

Yes, you can autosave directly into this account (Savings Plans settings can be found on the profile tab) and also perform manual saves at any time should you wish by selecting the account in the savings tab and tapping ‘deposit’. Saves into this account also count toward your in-app savings goals that you can set up in the ‘Goals’ tab. Please see our pricing plan page for further information.

You can open and manage any savings account in Chip on behalf of someone else, but you will need Power of Attorney over the account holder’s financial affairs. In order to set up or manage an account for someone using Power of Attorney you will need to talk to our customer support team via in-app chat or by emailing hello@getchip.uk

The team will walk you through the process, but they will ask for a few documents to prove you have Power of Attorney:

- An ID document of both you (the person acting as Attorney) and the account holder

- A proof of address for you (the person acting as Attorney)

- A Lasting Power of Attorney document (LPA) for Property and Financial Affairs