Market Volatility

Guide Summary

Falling markets can be unsettling, especially when you see the value of your investments drop suddenly. However, it's important to remember that market volatility is part of the ebb and flow of investing and is perfectly normal to experience.

Here's how to handle a market downturn with confidence, and keep your wealth building journey on track.

1. Stay calm and avoid rash decisions

During a market downturn, it can be tempting to sell off your investments to avoid further losses. However, making impulsive decisions based on fear often results in selling low and locking in losses.

We are only human, so we have a natural aversion to loss, but try to stay calm, shut out the noise, and remember that markets have historically recovered from downturns over time.

2. Focus on your long-term goals

Investing is for the long-term (a period of five years or more) so during a down period, it's really important to remember why you started investing in the first place. Chances are, it’s for those long-term goals like retirement or buying a home.

Market downturns can throw you off-balance but are often only temporary. Keep your focus on your big objectives and resist the urge to react to short-term market movements that don’t align with your long-term plan.

3. Check your diversification

Use a downturn to do a quick portfolio health check. Make sure your investments align with your risk tolerance, if they don’t, this could be the time to diversify your portfolio.

Consider diversifying investments across different asset classes, markets and sectors to potentially lessen the impact of a downturn.

For example, if you see that tech was more affected by a market downturn than other sectors (as we saw in August 2024). This could mean your portfolio is too heavy on tech funds, so consider diversifying into other areas such as energy or luxury goods.

4. Ignore the headlines

It's easy to get caught up in negative news and market hype, but focusing on this can lead to poor investment decisions. Instead, stay informed, zoom out and try to understand the wider picture. Always make decisions based on sound financial logic rather than emotions.

We’re only human and we know market downturns can be scary – the news media will add to the anxiety with headlines like ‘market crash’ and ‘stocks plummet’ and all manner of sensationalism but try to avoid the noise and focus on your goals.

5. Use the downturn to your advantage

Want the opinion of a billionaire?

Legendary investor Warren Buffett is famously quoted as saying, “Be fearful when others are greedy and greedy when others are fearful.”

He was advocating for sometimes going against the crowd. When others are gripped by fear and selling their investments, prices often drop to more attractive levels. This can be the time, according to Buffett, for savvy investors to be “greedy” and take advantage of the situation.

6. Keep on investing regularly

It can be tempting to stop investing when markets are down, but there can be a benefit to sticking with it. By continuing to invest you can take advantage of lower unit prices and accumulate more units for the same amount of money.

This strategy, known as pound-cost averaging, helps reduce the average cost per unit over time and smooth out the ups and downs of the market. Chip’s recurring deposit feature can help you do this automatically.

Finally, zoom out for some perspective.

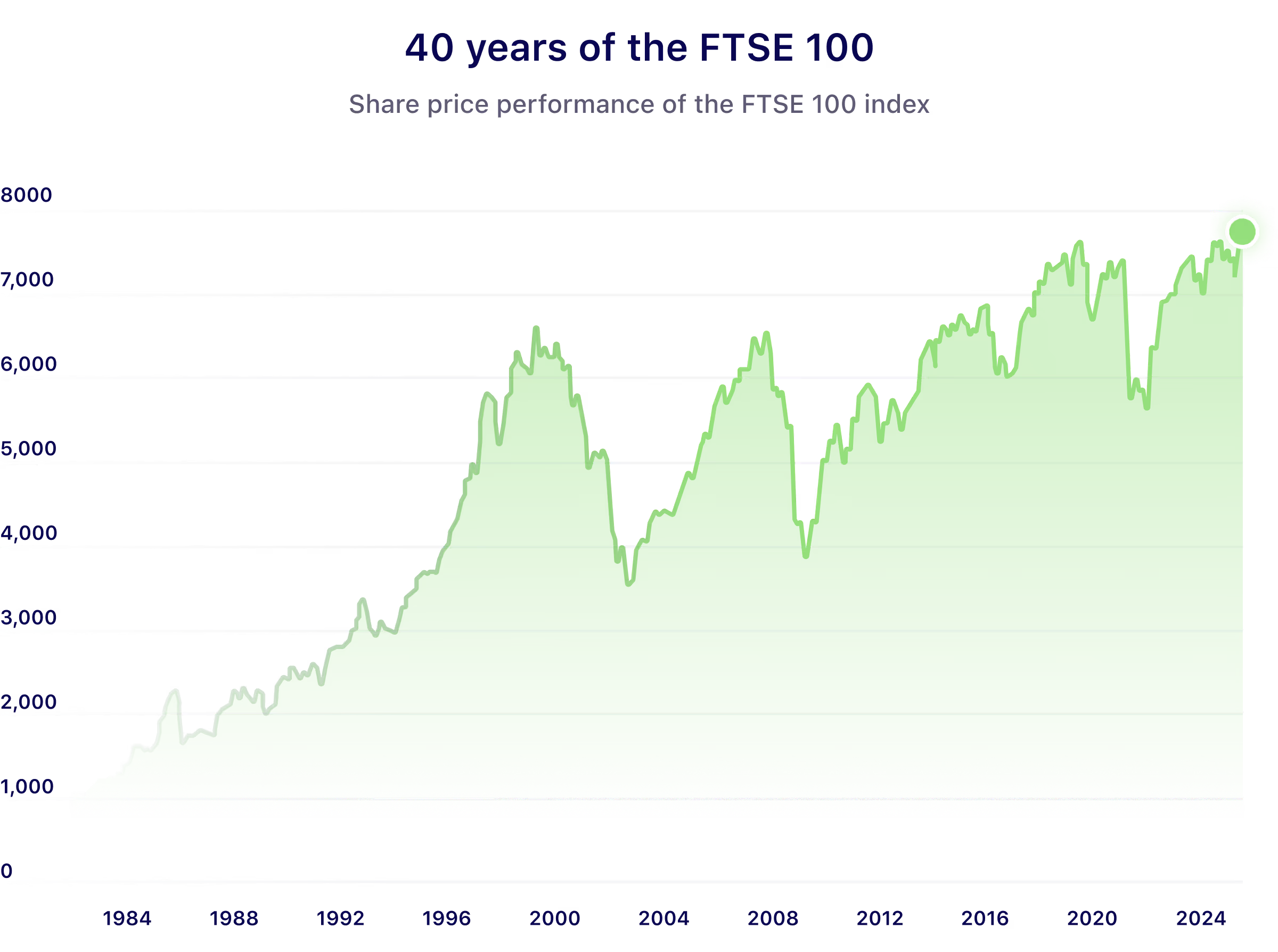

Markets can experience a significant drop but it’s worth noting that every crash to date has eventually recovered and gone on to an even stronger recovery.

While past performance isn’t a reliable indicator, the chart below shows some of the most significant market declines and recoveries across 40 years of the FTSE 100 – the well known UK stock market index.

In recent times, despite the turbulence of the global pandemic and on-going war in Ukraine, the FTSE 100 hit an all time high on 7 May 2024.

We’re here to help

Please reach out to the team if you have any questions or concerns. Remember, this isn’t investment advice and always keep in mind your own personal circumstances, financial situation and risk tolerance before investing.Let’s build wealth together.